Choosing the right options

The benefit plan has options for everyone.

Option 1 means you’re “opting out” of coverage. This is typically only chosen by employees who have enhanced coverage somewhere else, such as through a spouse’s plan.

If you choose option 1, this will free up flex credits that you can deposit to your Health Care Spending Account, Group RSP or Tax-Free Savings Account, or take as taxable cash.

Option 2 provides basic coverage and is fully covered by the flex credits that Johnson & Johnson provides you. This option may be suitable if you have:

- Minimal health and dental expenses

- Coverage through another plan (such as your spouse’s) and you can coordinate benefits between the two plans

If you choose option 2, this will free up flex credits that you can deposit to your Health Care Spending Account, Group RSP or Tax-Free Savings Account, or take as taxable cash.

Option 3 offers intermediate coverage.

This is a good option for many. Even for those with relatively few expenses, this option offers peace of mind in case you encounter any unexpected health expenses.

If you choose this option, you will pay a portion of the increased cost through regular payroll deductions.

Option 4 provides enhanced coverage, for employees with greater health expenses. If you choose this option, you will pay a portion of the increased cost through regular payroll deductions.

We’ve improved the flex plan

New practitioners:

Addition of the audiologist, dietician, and occupational therapist (under the same maximum as all other practitioners).

Vision care examinations:

The plan now covers up to $100 every 12 months (previously, it was $60 every 12 months).

Addition of Gender Affirmation coverage:

To supplement provincial and territorial benefits for those on a gender identification journey.

At Johnson & Johnson, we embrace a simple yet powerful belief: when you feel better, you perform better — in every aspect of your life. As you start making your benefits choices, think about what type of coverage you and your family might need. Consider if you have some upcoming expenses like new eyeglasses or braces for one of your kids.

Not sure what options suit you best? Are you more like Ashley, Scott or Mary?

Ashley

- Single

- No dependents

- Doesn’t own any property

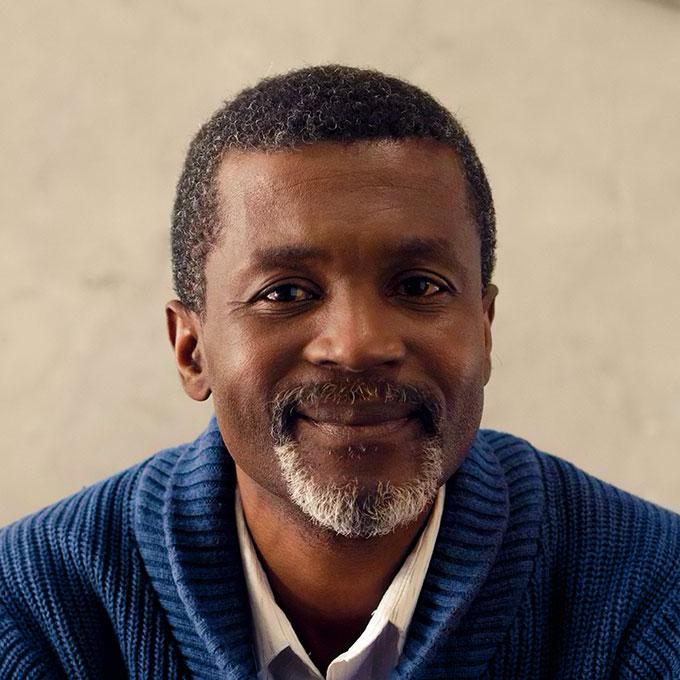

Scott

- Married to a self-employed partner who does not have a benefit plan

- One dependent teenage daughter

- Has a mortgage on current home

Mary

- Married to a partner with a benefit plan

- Owns her home mortgage-free

- Planning to retire in the next three to five years

Ashley

- Single

- No dependents

- Doesn’t own any property

Scott

- Married to a self-employed partner who does not have a benefits plan

- One dependent teenage daughter

- Has a mortgage on current home

Mary

- Married to a partner with a benefits plan

- Two adult children who are no longer eligible to be covered under their parents’ plans

- Owns her home mortgage-free

Extended medical care |

Since Ashley has very few medical expenses, she chooses option 2 for extended medical coverage. This option ensures that she has coverage, but also leaves her with some extra flex credits.

If Ashley wants increased coverage under the extended medical care plan, she may also consider option 3, which she will have to pay a portion of the increased cost through direct payroll deductions. Under this option, she wouldn’t have any flex credits remaining.

Scott and his family have a number of prescriptions to fill throughout the year. Both his partner and his daughter wear glasses. He chooses option 4 for extended medical coverage to help with these expenses.

If Scott doesn’t want to contribute to option 4 coverage, he may also consider option 3, which he will have to pay a portion of the increased cost through direct payroll deductions.

Mary is getting closer to retirement and is concerned about having good coverage in case anything unexpected happens. She chooses option 3 for extended medical care because it offers intermediate coverage.

If Mary’s partner’s benefit plan offers good coverage, she may also consider option 2. This option would leave Mary with extra flex credits to direct to other components of the plan.

Dental care |

Ashley uses her dental care plan for check-ups and cleanings, so she chooses option 2. This option ensures that she has coverage, but also leaves her with some extra flex credits.

If Ashley wants increased coverage under the dental care plan, she may also consider option 3, which she will have to pay a portion of the increased cost through direct payroll deductions. Under this option, she wouldn’t have any flex credits remaining.

In addition to Scott and his family’s regular check-ups and cleanings, his daughter also needs braces this year. With that in mind, he chooses option 4 for dental care.

If Scott prefers to pay for his daughter’s braces out-of-pocket instead of contributing to option 4, he may also consider option 3, which he will have to pay a portion of the increased cost through direct payroll deductions.

Mary and her partner typically use the dental care plan for check-ups and cleanings only, so she chooses option 2. This option ensures that they have coverage, but also leaves Mary with some extra flex credits.

If Mary wants increased coverage for herself and her partner under the dental care plan, she may also consider option 3, which she will have to pay a portion of the increased cost through direct payroll deductions. Under this option, she wouldn’t have any flex credits remaining.

Optional insurances (Life, AD&D, LTD) |

Since Ashley is young, healthy, has no dependents, and doesn’t own any property, she decides not to purchase any optional insurance. She believes that the basic insurance provided by Johnson & Johnson is enough for her current situation.

If Ashley wants increased protection, she may also consider some optional coverage for either Life, AD&D or LTD insurance.

With two dependents and a mortgage, Scott decides to get optional insurance coverage. He elects Life insurance for himself, his partner and his daughter. With increased Life insurance, Scott believes that he’s protected, so he sticks with the basic Johnson & Johnson provided AD&D and LTD insurance coverage.

If Scott wants increased protection, he may also consider some optional coverage for either AD&D or LTD insurance.

Mary and her partner are mortgage-free and their two adult children no longer depend on them, so Mary decides that she doesn’t need Optional Life or AD&D insurance. Mary does, however, want to be sure she’s protected in case of a prolonged illness, so she decides to increase her LTD insurance with the “buy-up” option.

If Mary wants increased protection, she may also consider some optional coverage for either Life or AD&D insurance.

Extra flex credits |

Ashley has flex credits left over since she chose option 2 for both extended medical and dental care. Since she wears contacts and glasses, she decides to direct all her remaining flex credits to her HCSA to help cover those expenses.

If Ashley wants an easy way to boost her savings, she may also consider moving some of her extra flex credits to the Group RSP.

Scott does not have any flex credits left over since he chose option 4 for both extended medical and dental care.

Mary has some flex credits left over since she chose option 2 for dental care. Since Mary feels adequately covered under the plan and is getting closer to retirement, she directs her remaining flex credits to her Group RSP account.

If Mary feels she has adequate retirement savings, she may also consider directing her extra flex credits to her HCSA for increased benefits coverage.

The “Help me decide” feature on the enrollment tool estimates your out-of-pocket medical and dental expenses.

All you need to do is provide basic information about your expected expenses and the tool does the rest of the work. If you don’t have that information handy, the tool can provide estimates for typical usage. Access this feature on the enrollment tool .

© 2026 Johnson & Johnson